California teacher retirement calculator

Many of these retirees have earned Social Security retirement benefits from other work during their lifetimes or for being an eligible spouse. Liz Truss will today announce a 150 billion package to freeze energy bills for up to two years as she ends the ban on fracking and gives the go-ahead for oil and gas drilling in the North Sea.

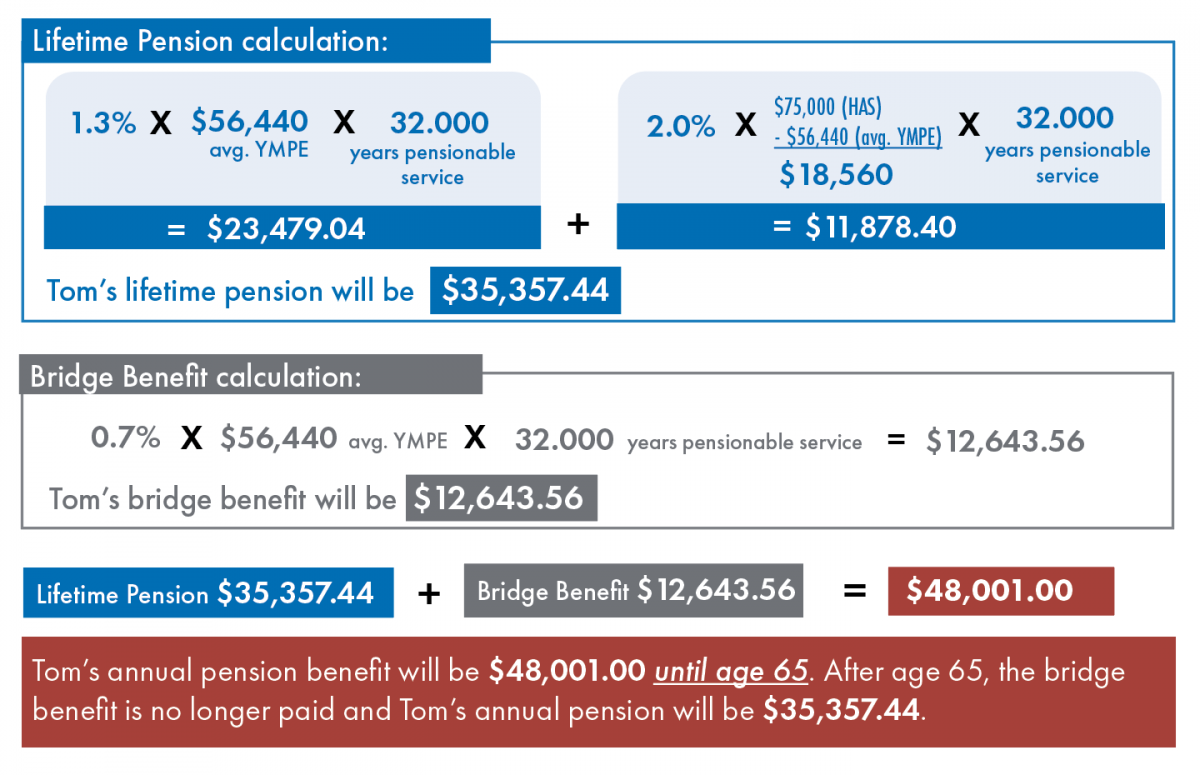

How We Calculate Your Pension Teachers Teachers

California is generally considered to be a high-tax state and the numbers bear that out.

. Are other forms of retirement income taxable in Louisiana. Your average tax rate is 1198 and your marginal tax rate is 22. This includes California teachers who are in CalSTRS.

There is a progressive income tax with rates ranging from 1 to 133 which are the same tax rates that apply to capital gains. She has taught at business and professional schools for over 35 years and written for The Balance on US. Use our free mortgage calculator to estimate your monthly mortgage payments.

A childhood curiosity about the world fueled by National Geographic set Nathan Lump on a path to becoming the magazines 11th leader since its founding in 1888. Jean Murray MBA PhD is an experienced business writer and teacher. You might consider concisely reviewing the value you added to the company over the years in your letterAt the very least include the number of years you worked for the company.

Heres how you can stay safe and maximize your profits by becoming a home sharing host in retirement. What Social Workers Do. Social workers help people prevent and cope with problems in their everyday lives.

To use this calculator youll need to get a copy of your earnings history from the SSA. Get 247 customer support help when you place a homework help service order with us. Mention your successes at the company.

This payout ratio is at a healthy sustainable level below 75. For example a resident of California can choose to invest in a 529 plan in Vermont in order to attend a college in the state of New York. If you return to CalSTRS-covered employment or if you are a member of another California public retirement system you may.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. 6 min read Sep 06 2022 Best places to roll over your 401k in September 2022. Californias Overall Tax Picture.

Income from a 403b 401k or regular IRA is subject to the state income tax in Louisiana. Learn about our editorial policies. However the earnings portion of a non-qualified distribution will usually be subject to ordinary income tax and a 10 tax penalty though there are.

The Golden State also has a sales tax of 725 the highest in the country. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Contributions to 529 plans can be withdrawn at any time.

Your household income location filing status and number of personal exemptions. His wife retired at the same time and filed for her Social. File a DIY Petition for Expungement in California.

WEP Windfall Elimination Provision. As a result this site has been retired. Limited Liability Company Accessed Dec.

The true state sales tax in California is 6. California Franchise Tax Board. This marginal tax rate means that.

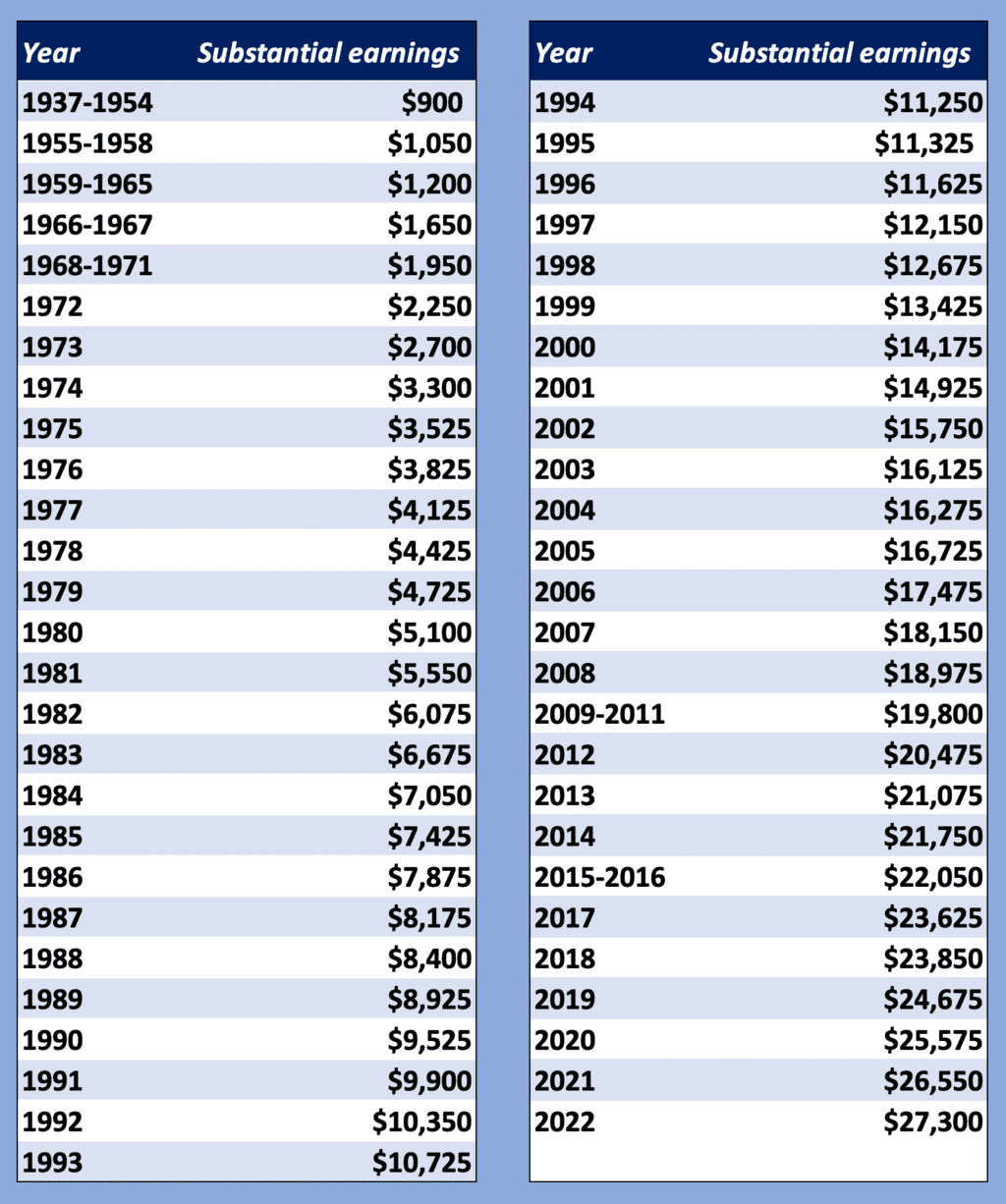

Hearst Television participates in various affiliate marketing programs which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. You should only put in your years of earnings that were covered by Social Security. This lets us find the most appropriate writer for any type of assignment.

This calculator is provided as a retirement planning tool to help you estimate your future retirement benefit. This tax does not all go to the state though. On average CalSTRS retirees collect 90 more than the equivalent Social Security recipient.

Banc of California does not have a long track record of dividend growth. The GPO and WEP cut or eliminate earned Social Security retirement benefits. Banc of California pays a meaningful dividend of 140 higher than the bottom 25 of all stocks that pay dividends.

If you make 70000 a year living in the region of Virginia USA you will be taxed 12100. The dividend payout ratio of Banc of California is 1491. You can get a copy of your record from the superior court.

The state then requires an additional sales tax of 125 to pay for county and city funds. Give a date. In contrast CalPERS retirees receive a pension up to 5 times greater than Social Security payouts for individuals with an equivalent working history and age.

Income from a public pension such as a state teachers retirement system or the Federal Employees Retirement System pension is exempt but non-public pension income is not. Social workers are employed in a variety of settings including child welfare and human service agencies healthcare providers and schools. Due to Adobes decision to stop supporting and updating Flash in 2020 browsers such as Chrome Safari Edge Internet Explorer and Firefox will discontinue support for Flash-based content.

Business law and taxes since 2008. Account for interest rates and break down payments in an easy to use amortization schedule. All in all youll pay a sales tax of at least 725 in California.

Upon retirement he began receiving his California teachers retirement pension of 3000 per month. California Sales Tax. Early in the letter give a specific date for your retirementThis will help both you and your employer avoid putting off your retirement.

Barbara Friedberg is an author teacher and expert in personal finance specifically investing. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. If youre looking to file a petition for expungement without an attorney in California follow these steps.

The Bureau of Labor Statistics is the principal fact-finding agency for the Federal Government in the broad field of labor economics and statistics. For nearly two decades she worked as an investment portfolio manager and chief financial officer for a real estate holding company. Calculations are estimates only.

Obtain a copy of your criminal record. 2 To estimate how your pension may compare to a Social Security retirement benefit use this Calculator. California requires probation to be complete before.

The minimum sales tax in California is 725. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Retirement Benefits Calculator Youtube

2

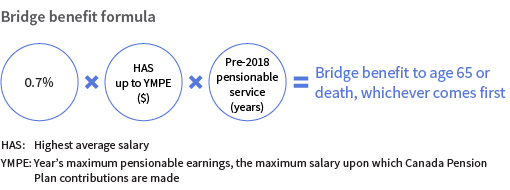

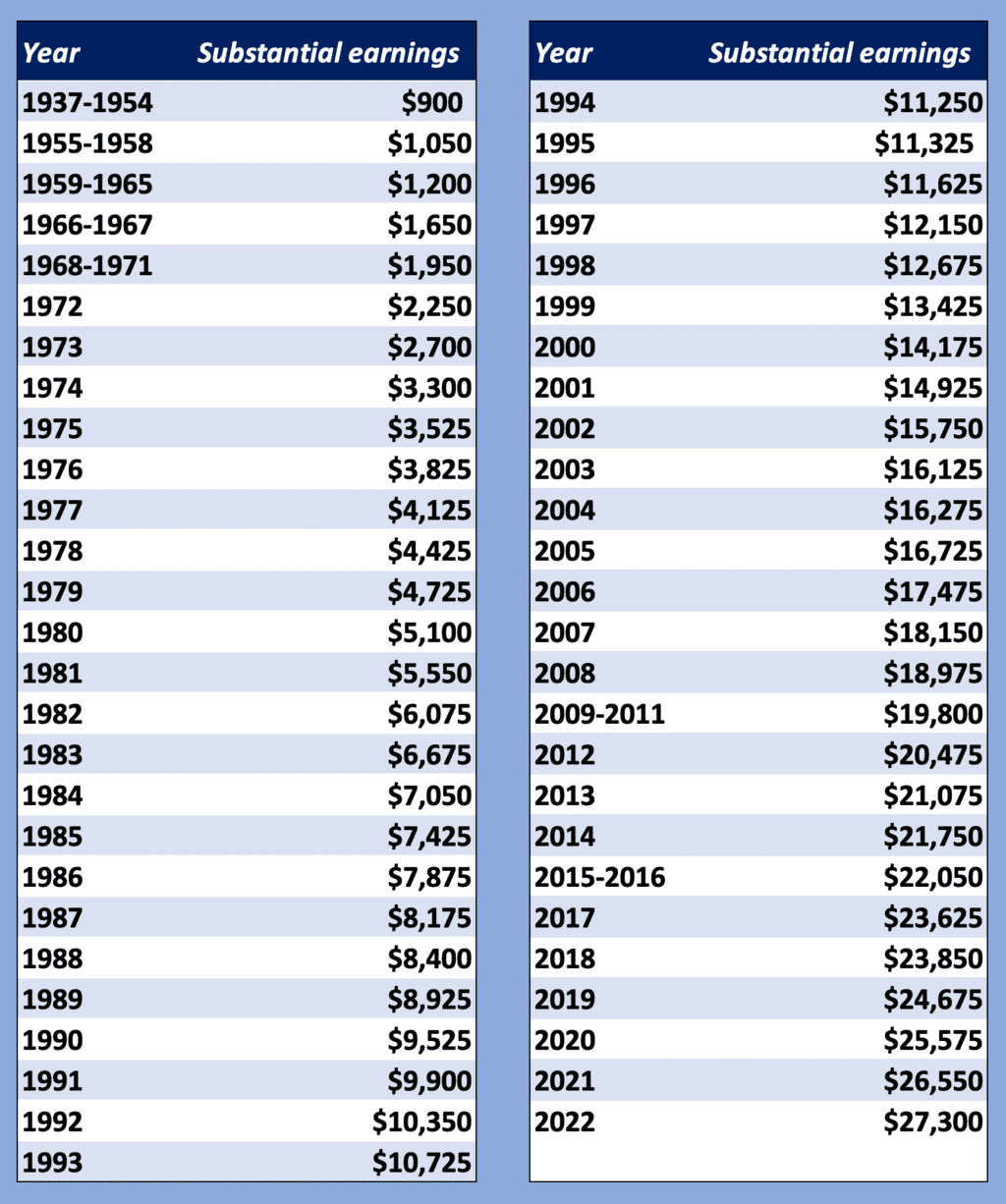

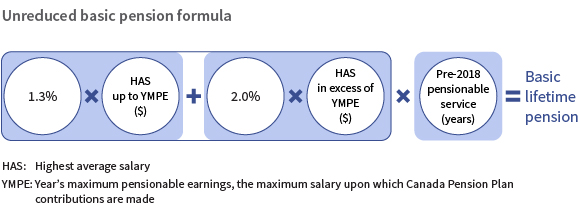

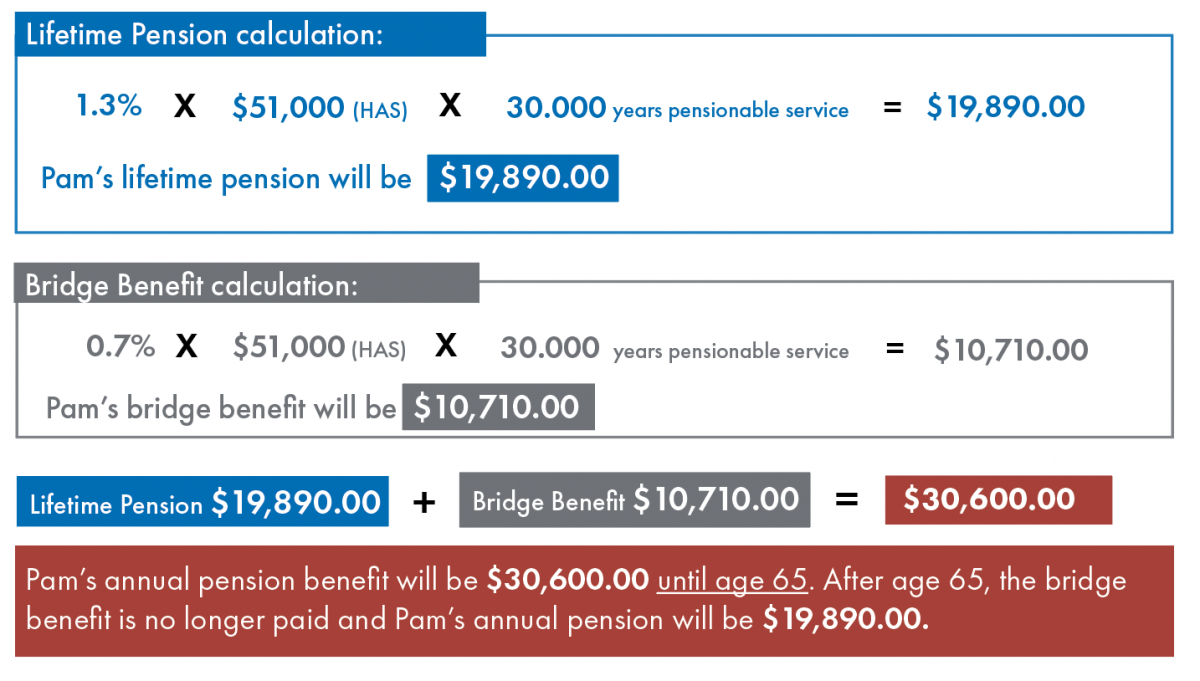

How Your Pension Is Calculated Nova Scotia Teacher S Pension Plan

Calculating How Much Money I Need To Retire Homeequity Bank

How Do You Calculate A Teacher Pension Teacherpensions Org

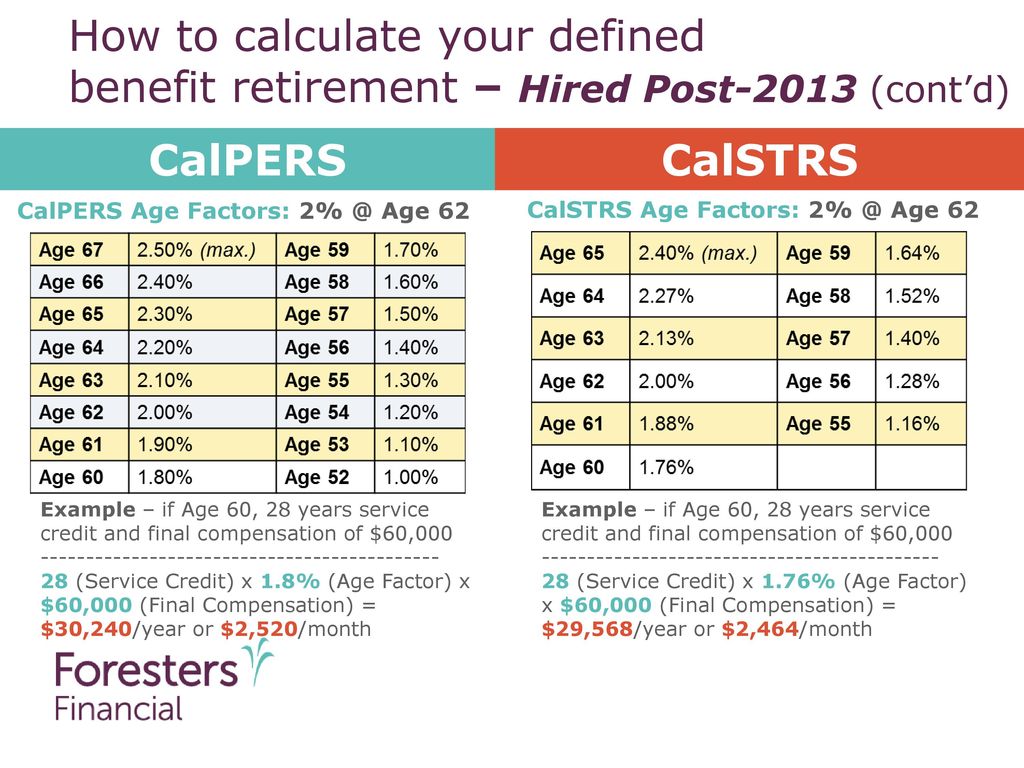

California Public California State Employees Teachers Ppt Download

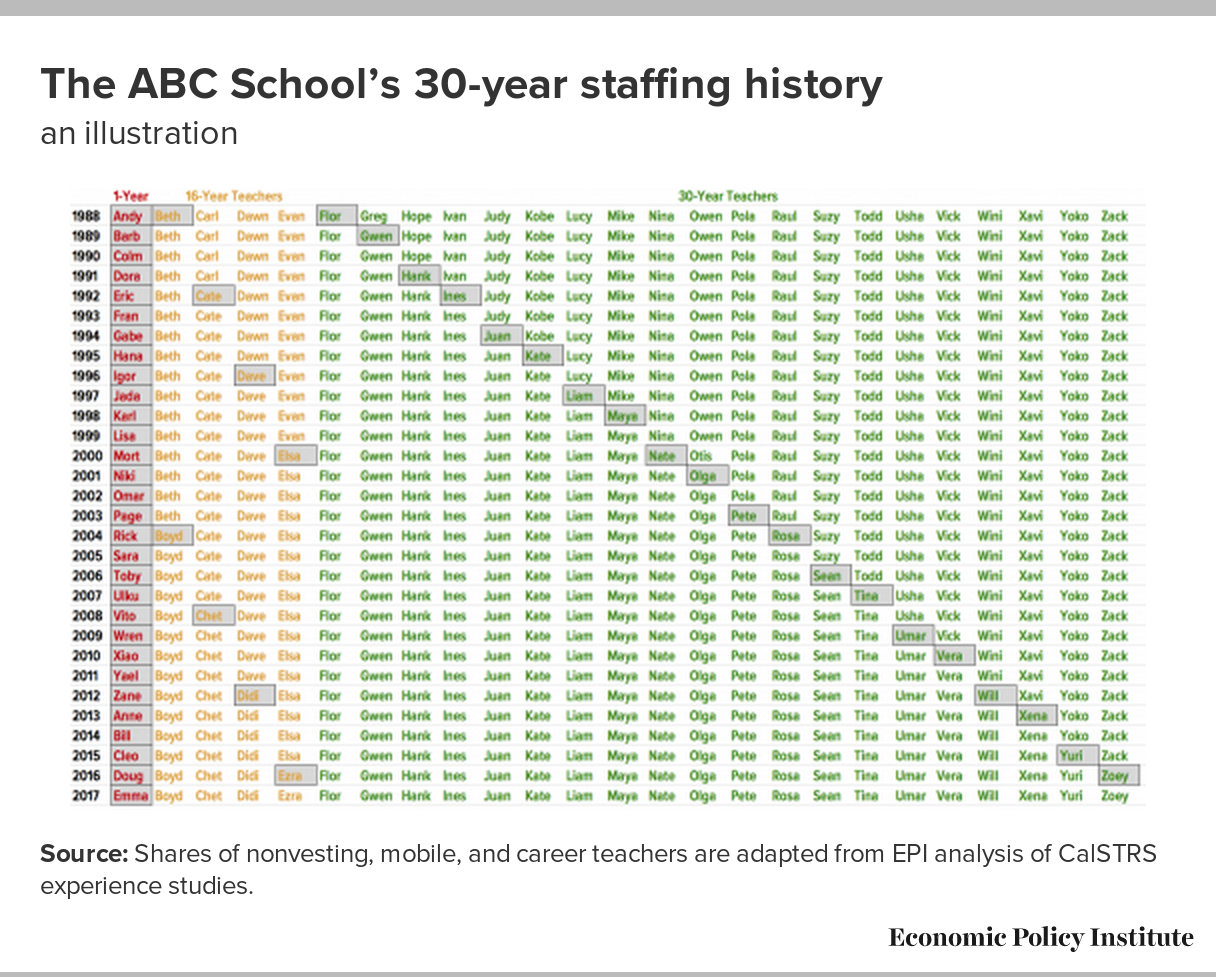

Teachers And Schools Are Well Served By Teacher Pensions Economic Policy Institute

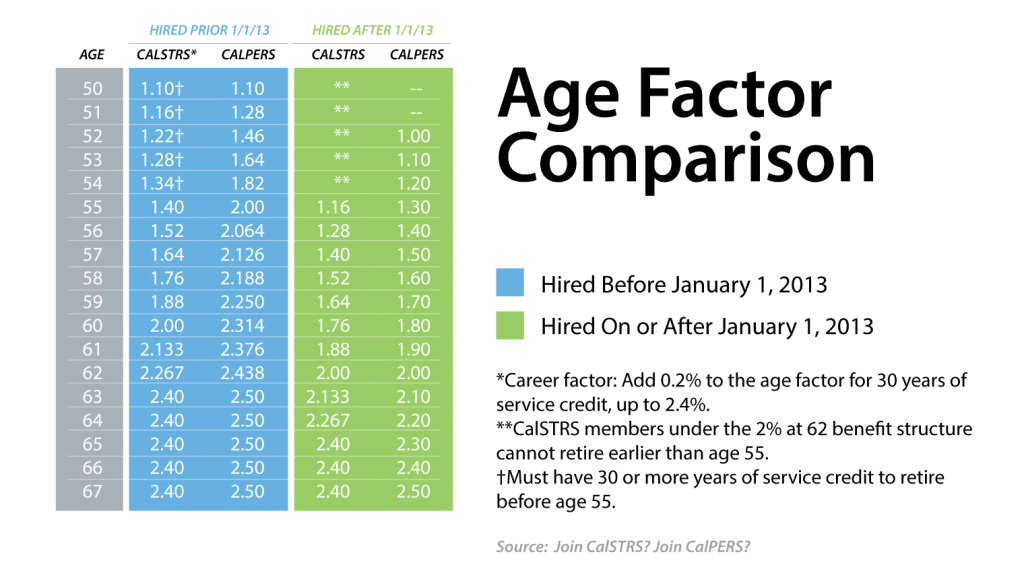

Planmember Calstrs And Calpers Retirement Benefits

How We Calculate Your Pension Teachers Teachers

Are Annual Contributions Into Calstrs Adequate

California Teacherpensions Org

Overview Of Calstrs

Ny Teacher Pension Calculations Made Simple The Legend Group

Understanding The Formula Calstrs 2 At 60 Youtube

All About Your California Calstrs Pension A Teacher S Guide To Personal Finance

How Your Pension Is Calculated Nova Scotia Teacher S Pension Plan

Teacher S Retirement And Social Security Social Security Intelligence